How to Setup WeChat Pay for Foreign Businesses

With over 1 billion users, WeChat is the most popular social medium in China. It presents unprecedented opportunity for reaching Chinese people. And while WeChat is the preferred social platform, WeChat Pay is the country’s preferred payment platform.

Whether in convenience stores, taxis, hotels, restaurants, or any other transactional situation, the Chinese pull out their phones to pay, propelling China to the virtually cash- and card-less economy it is today.

However, there are stringent and complex requirements for businesses to get onto WeChat and WeChat Pay, particularly businesses foreign to China.

Here, we share how foreign businesses can establish a presence on WeChat Pay and leverage the largest pay system in China. There are two options we’ll discuss:

- Setup via Tencent-authorized WeChat Pay service providers

- Setup via Tencent directly

Note:

- Tencent is WeChat Pay’s parent company.

- Different countries have different setup conditions. The Egg provides general information.

- Requirements may change. For more details, please inquire with your local WeChat Pay service providers.

Option 1: Setup via Tencent-authorized WeChat Pay service providers

WeChat Pay has partnered with authorized payment agencies to help brands in different countries setup cross-border payments on WeChat Pay.

Details

- It usually takes 1-2 weeks to setup your WeChat Pay account through an authorized WeChat partner.

- There are flexible refund options; usually you will be able to refund an order made within the past month.

- There is a low cash-out amount (usually between USD $0-5,000). The cash-out amount refers to when WeChat will transfer funds to your bank account.

- The service provider will charge a small premium, usually 2-3%, on top of the WeChat Pay rate/transaction.

Option 2: Setup via Tencent directly

Brands can setup WeChat Pay directly through Tencent on the WeChat Pay website. Any payments you receive will settle directly from Tencent’s bank account to your company account.

Details

- It usually takes around 2-4 months to setup your WeChat Pay account through Tencent directly.

- The refund options are limited; you will only be able to provide a refund if the amount of the incoming transactions on that day is greater than the refund amount.

- The minimum cash-out amount is USD $800 (or its equivalent in other currencies).

- WeChat Pay will take 1-2% commission on all transactions.

Application Requirements

Regardless of whether you’re setting up WeChat Pay through option 1 or 2, there are several requirements you must meet and documents you must provide:

- Business registration certificate

- Financial license

- Anti-money laundering agreement

- Identification documentation of all directors

- Primary business contacts and legal representatives

All businesses must comply with all the applicable laws and in accordance with WeChat Pay requirements. Tencent reserves the right to final interpretation and refusal of account creation.

Settlements

Supported Currencies

- GBP

- HKD

- USD

- JPY

- CAD

- AUD

- EUR

- NZD

- KRW

- THB

- SGD

- RUB

- DKK

- SEK

- CHF

- NOK

Settlement Model

Settlement Amount

The minimum amount of transfer to merchant by Tencent is USD $800 (or its equivalent in other currencies). If the settlement payment to merchant is less than USD $800 (or its equivalent in other currencies) in any settlement period, such settlement payment will not be remitted to merchant and will be accrued to the next settlement period.

Settlement Period

Settlement shall be made on a T+1 basis, which means that a transaction made on T day shall be settled on T+1 (in case of a statutory public holiday where Tencent is located, settlement shall be made on the day following the statutory public holiday).

The handling fee of transfer shall be split between the parties:

- The handling fee for receivables by merchant from Chinese banks to a foreign bank shall be borne by Tencent.

- All other charges, such as the costs of intermediary banks or receiving banks, shall be borne by merchant.

How does WeChat Pay work?

Quick Pay

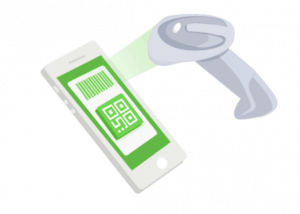

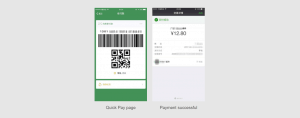

For point-of-sale transactions, a user will open his/her phone to show his/her bar code or QR Code on WeChat’s Quick Pay page for the vendor to scan and deduct the payment amount from the user’s WeChat Pay wallet. This mode is applicable for in-store payments.

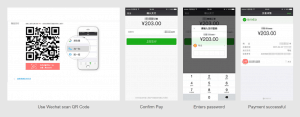

QR Code Payments

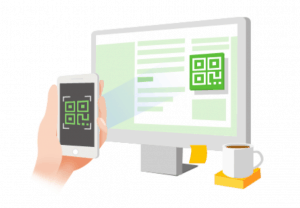

The vendor will generate a QR Code according to the WeChat Payment Protocol, and the user will scan the QR code to complete payment. This mode is applicable for website, in-store, and media/advertising payments.

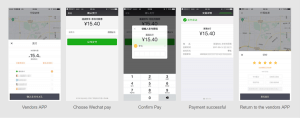

In-App Payments

In-app payment is also referred to as mobile-based payment, and it’s when the vendor opens the SDK function integrated in the mobile WeChat app to allow users to pay for transactions.

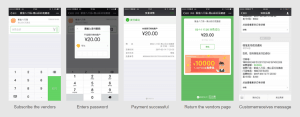

In-App Web-Based Payments

For this type of transaction, the user opens the vendor’s HTML5 pages through the WeChat app and uses the JSAPI interface to pay.

This mode is applicable in the following scenarios:

- The user enters the vendor’s WeChat Official Account and completes payment on the transaction page.

- The user’s friend shares the vendor’s payment URL in a chat or in Moments, and the payer clicks the link to complete payment.

- The user scans the payment QR code displayed on the vendor’s page and opens it in a browser to complete payment.

WeChat Pay has become the norm

WeChat Pay has become a part of daily life in China. With WeChat Pay enabled on the vast majority of mobile phones in China, users make payments anytime, anywhere. A physical wallet with cash and cards is not only no longer required, it is quickly becoming a relic of the past.

In China, WeChat Pay is supported virtually everywhere, including taxis, supermarkets, websites, convenience stores, and hospitals.

WeChat Official Account + WeChat Pay: Connect with Chinese consumers + increase business opportunities

To sell to and conduct business with a Chinese audience, WeChat Pay is an essential medium. It connects foreign businesses directly to Chinese consumers so that they can pay for overseas vendor transactions using RMB. The payments are then transferred to your overseas bank account in whichever acceptable foreign currency is most convenient for you as a vendor.

Because WeChat Pay can be linked to a WeChat Official Account, you have an opportunity to generate greater brand awareness by opening a WeChat Official Account and encouraging your WeChat Pay users to follow and engage with your account.

You can then create and communicate compelling content about your products, services, and brand targeted at your WeChat Pay users. This of course should be content of interest and value to your audience to encourage them to share your articles and account with their friends.

Essentially, the benefit of WeChat Pay is two-fold: you provide an efficient and systematized payment method for your Chinese customers while increasing brand awareness, followers, and sales.