Homegrown Inspiration: Singapore’s Top 5 Travel Search Trends in 2021

Travel bubbles, cruises to nowhere, glamping, staycations—despite the pandemic rendering international travel all but impossible, demand for travel content in Singapore soared as people searched for the perfect local getaway.

Travel confidence, meanwhile, continues to grow as vaccine programs steam ahead, with 81% of global travelers citing an increased likelihood of travelling once they are vaccinated. In Singapore alone, whose economy has undergone a Phase 3 reopening since December 2020, 61% of residents say they plan to travel abroad by late 2021.

What’s more, a Booking.com travel survey found that the vast majority of Singaporeans—over 96%—have searched for travel-related content this past year, with 32% even making a habit of scouting potential vacations once per week.

So, did the pandemic slow or spark consumption of travel content?

Similar to our research on travel search trends in Hong Kong and China, let’s examine Singapore’s 5 hottest travel topics to contextualize travel demand in the region, using Dragon Metrics—an all-in-one global SEO research tool—to discover how you can rank for these terms on Google.

Singapore Travel Search Trend #1: “Travel Bubble”

For an economy that runs on tourism, finance, and trade, Singapore is among the world’s hardest-hit regions—but also among the first to ease restrictions domestically. As such, searches for “travel bubble” have ebbed and flowed in response to the wider regulatory shifts over the past 12 months.

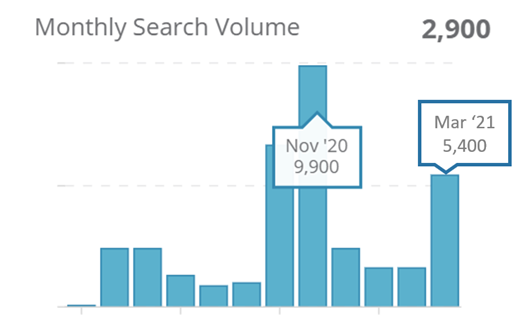

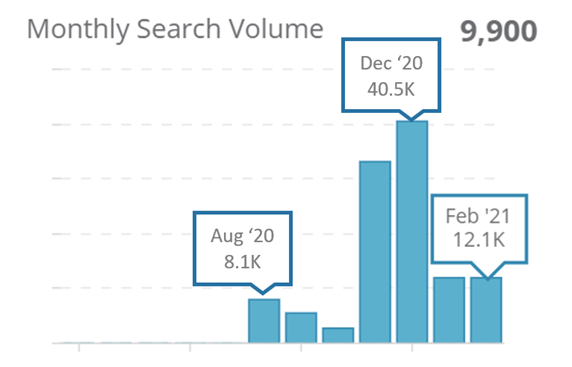

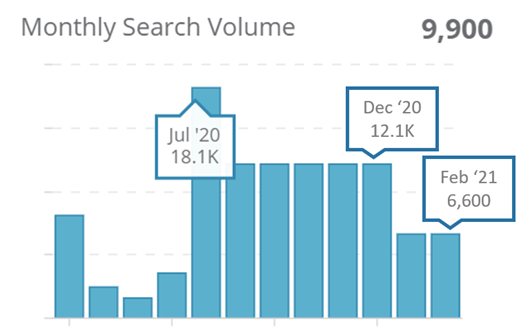

Monthly Search Volume: “Travel Bubble”

Once heralded as the world’s first, Singapore’s travel bubble with Hong Kong was deferred on the eve of its inaugural flight in November 2020 due to the latter’s rebound in confirmed cases. This turn of events explains the see-sawing of monthly search volumes (MSV) for “travel bubble” on Google Singapore in late 2020—peaking at 9,900 searches in November before dropping to 2,400 in December.

Since March 2021, however, travel bubble talks have kicked off between Singapore and other low-risk countries—like Australia, Malaysia, Brunei, and Taiwan. And amidst a revival of travel discourse, MSV for “travel bubble” spiked again from 1,600 to 5,400 searches between February and March 2021.

Monthly search volumes for “Travel Bubble” on Google SG

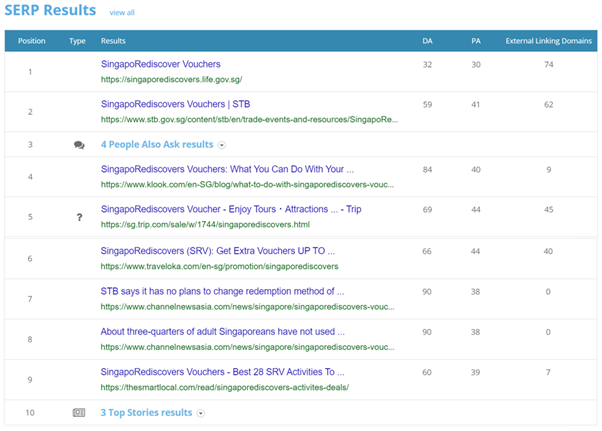

Top 10 Search Results: “Travel Bubble”

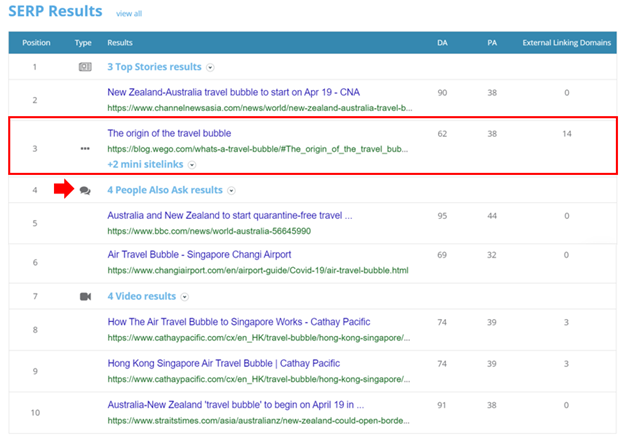

Dragon Metrics lets you view the sites ranked on the first SERP for any chosen keyword and attributes scores for each result based on 3 critical SEO metrics:

- Page authority (PA)—out of 100

- Domain authority (DA)—out of 100

- Each domain’s backlink strength

Diving into the competitive analysis for “travel bubble,” let’s explore which sites populate the SERP for this search term.

Dragon Metrics: Top 10 SERP results for “Travel Bubble”

As shown above, news outlets and official airline websites predominantly occupy the top 10 results for “travel bubble.” This is expected, as no travel bubbles with Singapore have been finalized, so the search intent most likely arises from inquiries about the latest government updates and announcements.

Nearly all of the top 10 sites have moderate PAs (between 32 to 44) and relatively high DAs (between 62 to 95), hinting that it would be challenging to outrank them for “travel bubble.” However, you’ll notice that one travel blog, Wego, ranked third on the SERP (outlined in red) by explaining the buzz and excitement behind this novel travel term.

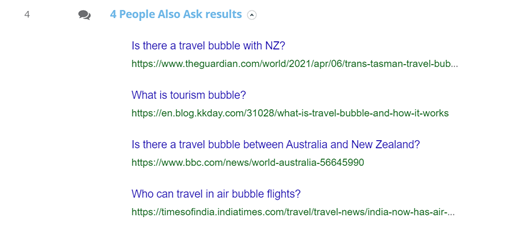

Similarly, the ‘People Also Ask’ results appeared above the fold, highlighting the search frequency of definitional questions like “what is tourism bubble?” or “who can travel in air bubble flights?”.

Dragon Metrics: ‘People Also Ask’ section on the “Travel Bubble” SERP

Thus, these findings highlight the potential to break into the top 10 results for “travel bubble” by creating captivating, well-researched content that tackles these frequently asked questions.

Moreover, since the preferred travel destinations for Singaporeans are Malaysia, Japan, Thailand, Hong Kong, and Australia, content that explores near-future travel to these destinations—two of which have already made headway in reopening borders with Singapore—may gain more traction over time.

Singapore Travel Search Trend #2: “Cruise to Nowhere”

The Singapore Tourism Board’s (STB) recent “cruise to nowhere” campaign turned out to be immensely popular among residents itching for a holiday retreat.

Cruise to nowhere

Monthly Search Volume: “Cruise to Nowhere”

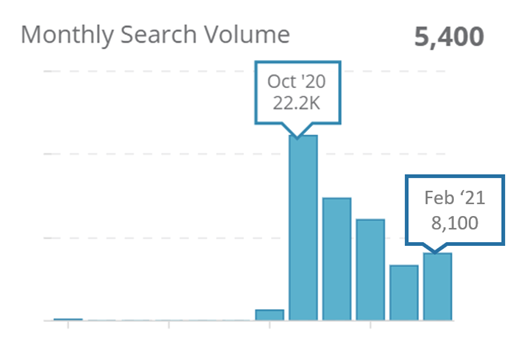

Search volumes on Google SG for “cruise to nowhere” increased considerably in late 2020 and have remained high ever since. The term peaked at 22,200 MSV in October 2020, when the STB announced it would begin piloting cruises—with no ports of call—for two homeported cruise lines: Genting Cruise Lines and Royal Caribbean International.

As of 31 December 2020, 33 cruises carrying over 42,000 passengers were completed with no reported incidents of COVID-19 transmissions on board.

Monthly search volumes for “cruise to nowhere” on Google SG

Top 10 Search Results: “Cruise to Nowhere”

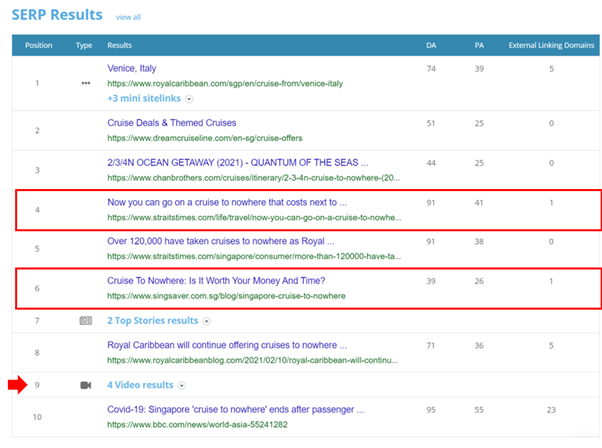

Using Dragon Metrics, let’s observe who ranks in the top 10 on the SERP for “cruise to nowhere”:

Dragon Metrics: Top 10 SERP results for “Cruise to Nowhere”

Unlike travel bubbles, Singapore’s cruises to nowhere have been around for 5 to 6 months as of April 2021, servicing tens of thousands of customers during that time. As such, the SERP for “cruises to nowhere” features blogs and online travel agencies (OTAs), where considerable information on cruise packages is concentrated and backed by customer reviews.

Most of these sites have moderate PAs (25 to 55) and varying DAs (39 to 95). Hence, outranking these top 10 results for “cruise to nowhere” may not be too difficult if you create engaging content about great cruise experiences and which deals are the most attractive.

Considering that 4 video results ranked 9th on the SERP, complementing your written commentary with embedded video can also improve your visibility—people are particularly keen to see first-hand cruise experiences.

Furthermore, you’ll notice the two blogs that ranked 4th and 6th on the SERP (outlined in red) discussed the costs of these cruise voyages. In fact, over 43% of Singaporeans cite budget as their primary consideration when traveling. Thus, it comes as no surprise that they would be meticulous in planning their itinerary, especially since travel insurance is oftentimes pricier during the pandemic.

With people scouring reviews and tactfully selecting their ticketing and accommodation, addressing these customer pain points is another opportunity to supercharge your way into the top 10 SERP results for “cruise to nowhere.”

Singapore Travel Search Trend #3: “Glamping”

Another leisure activity that surged in popularity during the pandemic was glamping—the portmanteau of ‘glamorous camping.’ It’s essentially camping with added luxury, style, and fun— a hassle-free way for residents to retreat from the bustling city and enjoy the outdoors.

While glamping can be enjoyed all year round in tropical Singapore, more unique takes on glamping have also come to the fore this year. A prime example is the overnight glamping program offered at Jewel Changi Airport, which has become a destination in itself rather than just a means to reach a destination.

Glamping at Jewel Changi Airport

Monthly Search Volume: “Glamping”

MSVs for “glamping” peaked at 6,600 searches in November 2020 and remained high at 4,400 searches in February 2021.

Monthly search volumes for “Glamping” on Google SG

Top 10 Search Results: “Glamping”

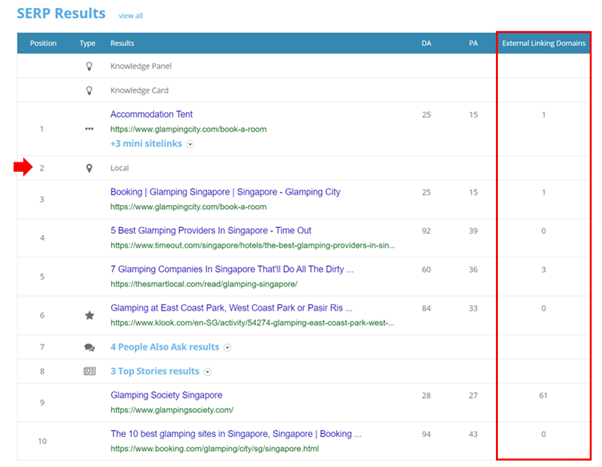

Dragon Metrics: Top 10 SERP results for “Glamping”

The top 10 SERP results for “glamping” are dominated by OTAs (Klook), blogs (Timeout), and—most noticeably—websites of Singapore-based glamping companies like Glamping Society and Glamping City.

The prominence of glamping companies on the SERP comes down to their ease of use in online booking, considering that the Singaporean government has made camping permits mandatory since the start of the Phase 3 reopening.

Based on the sites’ low to moderate PAs and varying DAs and their weak backlink profiles (outlined in red), outranking them for “glamping” won’t be too demanding if your on-page and off-page SEO is executed effectively and supported with relevant backlinks.

Moreover, local search results for “glamping” appeared high on the SERP at 2nd place. Therefore, if you’re a local glamping company looking to improve your SERP visibility, ensure you’ve filled out all the fields on your Google My Business profile and that your contact information and operating hours are updated. This is particularly important since your business massively relies on customers making reservations.

Singapore Travel Search Trend #4: “Staycation”

With international vacations decimated over the last year, many have indulged in domestic staycations.

Monthly Search Volume: “Staycation”

MSVs for “staycation” soared last year, climaxing at 18,100 searches in July 2020 amidst the summer holiday months. However, by January 2021, it dropped to 6,600 searches as considerable attention shifted to the buzz of glamping and cruises to nowhere.

Top 10 Search Results: “Staycation”

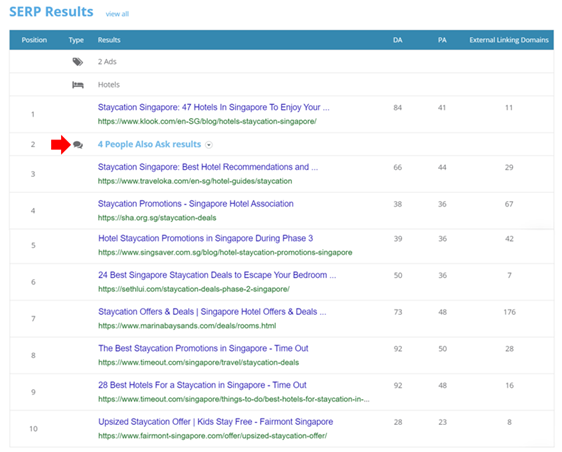

Dragon Metrics: Top 10 SERP results for “Staycation”

The top 10 SERP results for “staycation” primarily include OTAs and blogs, which are generally more convenient and information-dense for users looking for the best staycation package.

Most of these sites have moderate PAs (23 to 50) and varying DAs (28 to 92). And despite their relatively strong backlink profiles, ranking above them for “staycation” may not be too challenging if you create high-quality content that shares what staycation deals are available and how well-reviewed they are.

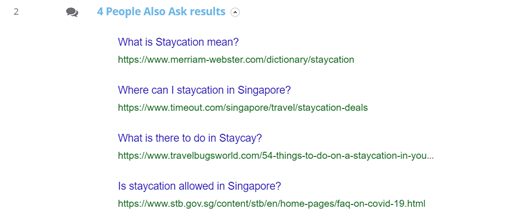

Dragon Metrics: ‘People Also Ask’ section on the “Staycation” SERP

Furthermore, the ‘People Also Ask’ results for “staycation” ranked in 2nd place on the SERP as people queried “what is staycation mean?” and “where can I staycation in Singapore?”. As such, addressing these user queries in your content can improve your visibility on the SERP.

Singapore Travel Search Trend #5: “SingapoRediscovers Vouchers”

In August 2020, Singapore’s government announced it would set aside SGD $320 million worth of vouchers to incentivize its residents to spend on staycations, local attractions, and special tours. That same month saw the first searches for “SingapoRediscovers Vouchers”, which totaled 8,100 monthly searches.

Monthly Search Volume: “SingapoRediscovers Vouchers”

MSVs for “SingapoRediscovers Vouchers” truly skyrocketed—peaking at 40,500 searches in December—only after five OTAs, preselected by the government, began offering redemption services for the vouchers.

These OTAs were Klook, Traveloka, Trip.com, GlobalTix, and Changi Travel Services.

Monthly search volumes for “SingapoRediscovers Vouchers” on Google SG

Top 10 Search Results: “SingapoRediscovers Vouchers”

Dragon Metrics: Top 10 SERP results for “SingapoRediscovers Vouchers”

As you can see, the top 10 SERP results for “SingaporeRediscovers Vouchers” largely feature the five aforementioned OTAs, as well as the Singapore government’s official website.

Most of these sites have moderate PAs (30 to 44) and moderate-to-high DAs (32 to 90). However, the fact that the five OTAs are government-backed automatically makes them the strongest SERP competitors for this term. And considering the voucher scheme is due to end on June 30, 2021, MSV for “SingapoRediscovers Vouchers” will likely drop and make competing for this term less pragmatic.

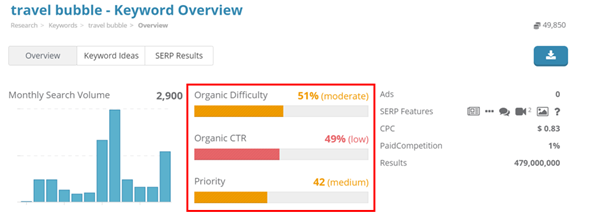

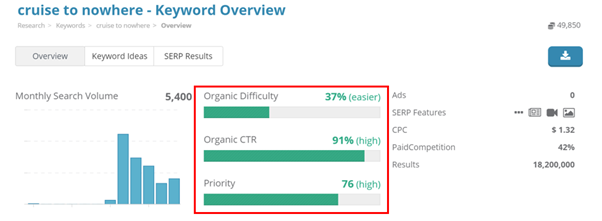

How to Target the Right Travel Keyword

Once you’ve identified a set of travel keywords to target, you can use of Dragon Metrics’ keyword research tool to prioritize keywords to get the most traffic. The platform assesses keywords with 3 key metrics:

- Keyword difficulty

Keyword difficulty measures the backlink strength of sites occupying page 1 of the SERP and unveils how many backlinks it takes to rank in the top 10 results.

- Organic CTR

Organic CTR reveals the percentage of clicks on organic results—based on the proportion of ads, rich results, and various SERP features. This is useful for identifying which keywords to de-prioritize, especially those that generate results below the fold.

- Priority

Priority represents a keyword’s organic traffic potential. It is an aggregate score made up of search volume, keyword difficulty, and organic CTR—lower keyword difficulty, coupled with higher search volume and organic CTR, yields a higher priority score.

Dragon Metrics: Keyword overview for “Travel Bubble”

Dragon Metrics: Keyword overview for “Cruise to Nowhere”

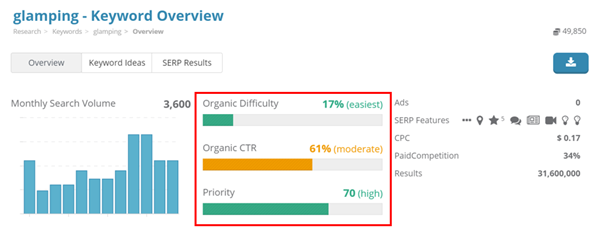

Dragon Metrics: Keyword overview for “Glamping”

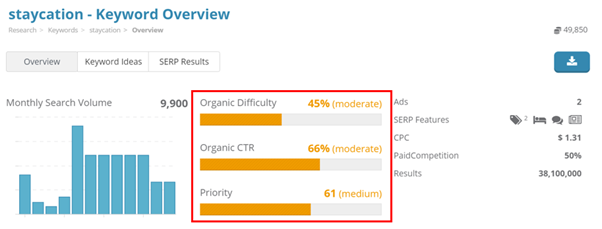

Dragon Metrics: Keyword overview for “Staycation”

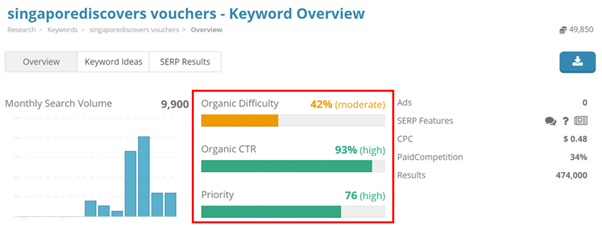

Dragon Metrics: Keyword overview for “SingapoRediscovers Vouchers”

According to the Keyword Overviews generated for each keyword on Dragon Metrics, all five display low to moderate organic difficulty, with “glamping” and “cruise to nowhere” being the easiest to rank for with the least amount of quality backlinks.

“SingaporRediscovers vouchers” and “cruise to nowhere” had the highest organic CTRs at 93% and 91% respectively, signifying that their SERPs predominantly consist of organic results. It is also a good indication that users generally find the ads and results on the first page helpful and relevant. The remaining three keywords, by contrast, had low to moderate organic CTRs—between 49% and 66%.

Per the priority scores, “SingapoRediscovers vouchers” and “cruise to nowhere” both shared top spot at 76, followed by “glamping” at 70, “staycation” at 61, and “travel bubble” at 42. Given their high priority scores, “SingapoRediscovers vouchers”* and “cruise to nowhere” are the travel keywords that have the best ranking likelihood due to their lower keyword difficulty and high organic CTR.

To this end, Dragon Metrics’ priority score can help you efficiently evaluate the keyword(s) to prioritize in your SEO to break into the top 10 SERP results.

*NOTE: With the SingapoRediscovers Voucher scheme concluding on June 30, 2021, it may be prudent to prioritize ranking for keywords other than “SingapoRediscovers voucher” due to the lack of keyword implementation time necessary to produce results.

***

Rather than diminish during the pandemic, travel inspiration remained high with people scratching their collective itch to travel again by searching online travel content.

Using Dragon Metrics, we can see that Singapore still experienced high search volumes for travel content over the last 12 months. Instead of booking holidays to places halfway across the world, people turned to homebound experiences (glamping, staycations, cruises to nowhere), indulged in retail therapy, and pondered the what-ifs of near-future travel bubbles.

As we look forward to travelling once again, particularly with vaccines becoming readily available, our appetite for travel content is expected to increase over time.

Pro-Tip: As The Egg’s sister company, Dragon Metrics is a proprietary tool developed as the first truly global SEO platform that provides rank tracking, onsite optimization reports, link management, keyword research tools, and more for search engines around the world. In this article, we look specifically at Dragon Metrics’ prowess on Google, but Dragon Metrics works for all of the world’s major search engines, including China’s.