Most Popular Search Engines in Japan – 2025

The Japanese search engine market, while partially similar to global trends, has its own unique characteristics.

First, a trend common to both Japan and the rest of the world is Google’s dominant market share. In Japan, Google accounts for more than 82% of the total market for PCs and mobile devices, mirroring global trends. However, one unique characteristic of the Japanese market is the presence of Yahoo!.

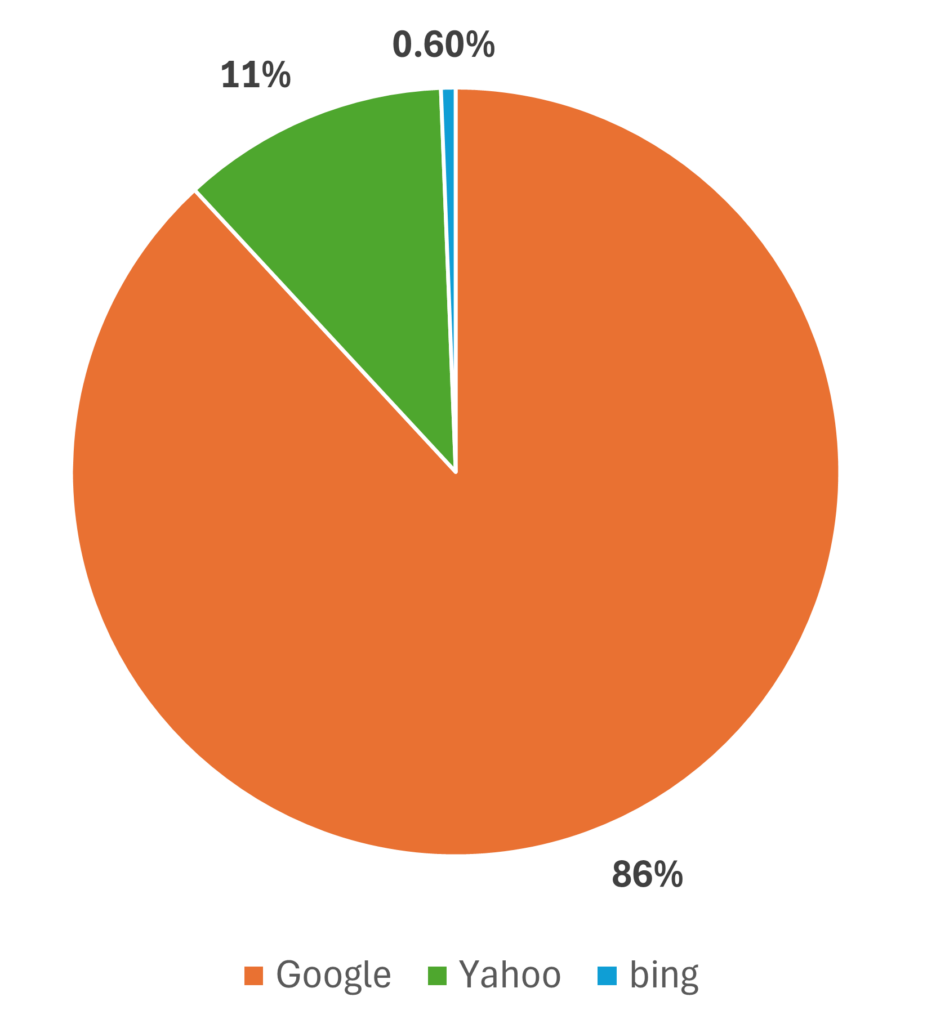

Yahoo! JAPAN maintains a significant share of just under 11% of the smartphone market, a remarkable difference compared to the global market and reflective of the habits and preferences of Japanese internet users.

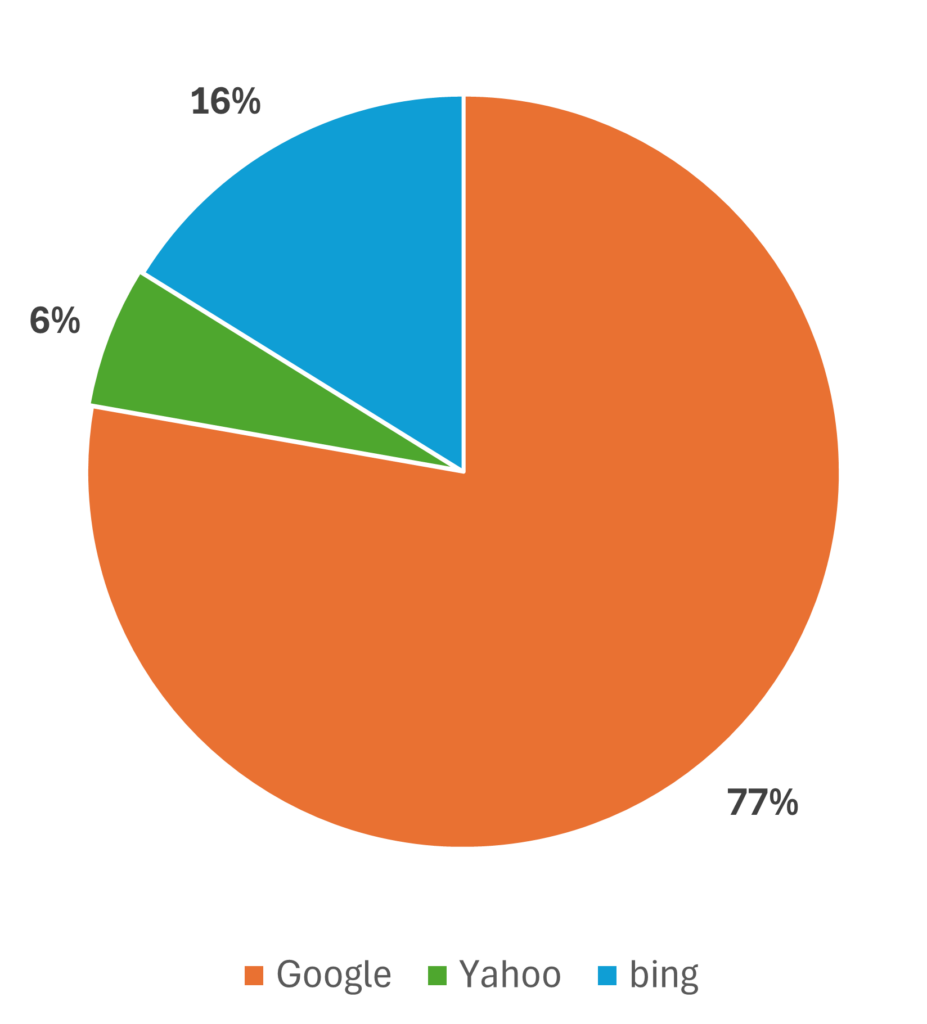

An interesting trend in the desktop market is that Bing’s market share in Japan is 16%, slightly higher than the global average of 12%. This suggests that desktop users in Japan are more likely to use Bing compared to users in other countries.

This article examines in detail the situation of search engines in Japan, based on the latest available data. We will analyze statistics obtained from reliable sources to provide a comprehensive overview of how Japanese people are using search engines. Let’s take a closer look at the search engine landscape in Japan.

Top Search Engines in Japan By Market Share

In terms of market share, Google is the most popular search engine in Japan, holding approximately 82% of the market. Even when broken down by device, Google maintains a dominant lead. On the other hand, compared to global trends, the relatively high share of Yahoo and the strong presence of Bing on desktop in Japan highlight the unique characteristics of the Japanese market.

Overall |

Desktop |

Mobile |

|

|---|---|---|---|

| 82% | 77% | 86% | |

| Yahoo! JAPAN | 9% | 6% | 11% |

| bing | 7% | 16% | 0.6% |

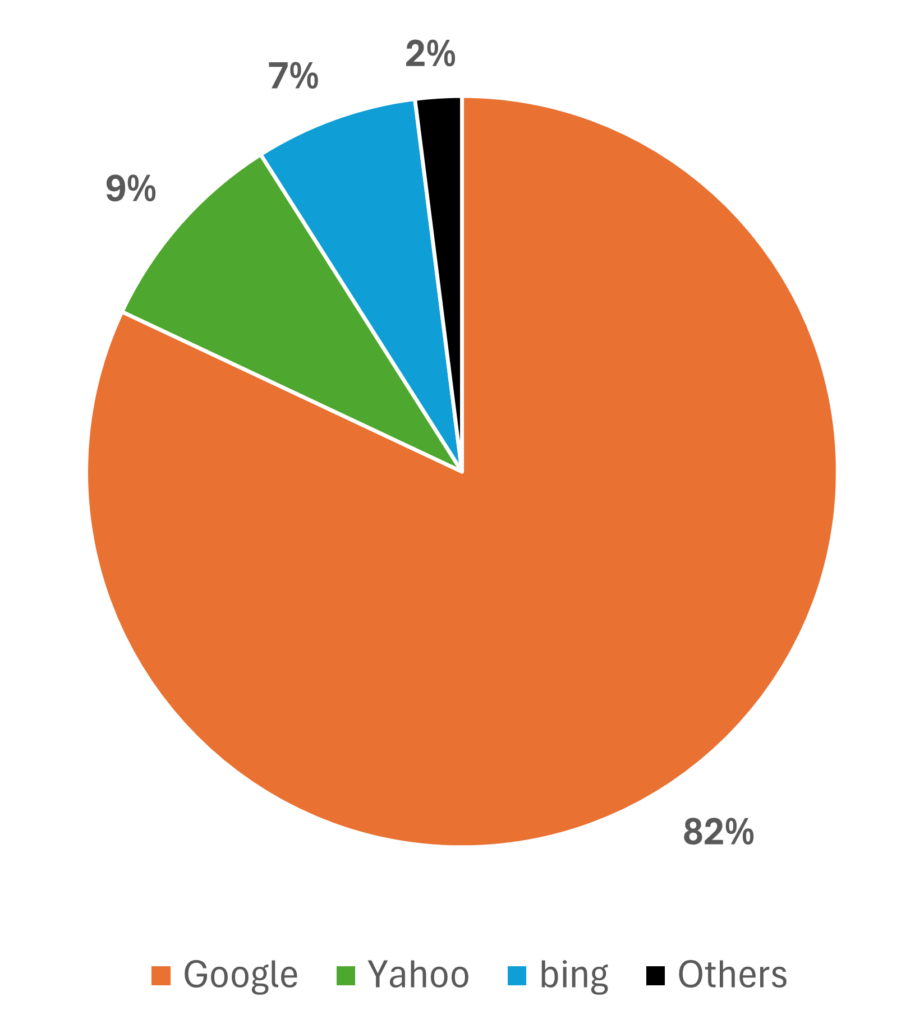

OVERALL

- Google: 82%

- Yahoo! Japan: 9%

- bing: 7%

- Others: 2%

Source: StatCounter (as of May 2025)

DESKTOP

- Google: 77%

- bing: 16%

- Yahoo! Japan: 6%

Source: StatCounter (as of May 2025)

MOBILE

- Google: 86%

- Yahoo! Japan: 11%

- bing: 0.6%

Source: StatCounter (as of May 2025)

WHAT’S UNIQUE ABOUT JAPAN’S SEARCH MARKET?

Unlike most other markets where a single platform typically dominates the search engine scene with over 90% market share, Japan’s search engine landscape is more diverse. Google and Yahoo are the two most popular search engines in Japan. As of May 2025, Google holds approximately 82% of the market share, Yahoo! JAPAN claims around 9%, and Bing’s market share has declined to approximately 7%, down from 11% in 2024, indicating a shift in user preferences.

The search engines’ respective mission statements all target creating a positive user experience:

AI IN ACTION

Japan’s search landscape is rapidly evolving with AI. Bing’s advanced AI features, like Copilot for conversational search, are reshaping how users find information. At The Egg, we actively integrate these AI shifts into our SEO strategies for Japan, ensuring our clients’ content is optimized for evolving earch patterns and AI-driven results.

Google’s mission is “to organize the world’s information and make it universally accessible and useful.”

Yahoo! JAPAN’s mission is “making Japan more convenient with the power of information technology.”

Microsoft’s mission is “to empower every person and every organization on the planet to achieve more”. While we didn’t find Bing’s exact mission statement, it’s worth noting that Bing is owned by Microsoft and operates under this overarching mission.

While Google aims to create a universal platform for users all over the world to access a global bank of information, Yahoo! JAPAN leverages that technology to provide the world’s information specifically to Japanese users. Bing, on the other hand, focuses on empowering users through knowledge, which aligns with Microsoft’s broader mission of enabling people to achieve more.

This competitive environment highlights the unique dynamics of the Japanese market, where multiple platforms coexist and cater to different user preferences and needs. The ongoing evolution of these search engines, particularly with the integration of AI technologies, continues to shape the search experience for Japanese users.

TOP SEARCH ENGINES IN JAPAN: RECENT TRENDS & PAST DATA

THE ORIGINS OF JAPAN’S SEARCH ENGINE MARKET

In 1996, Yahoo! JAPAN was established with an investment from Softbank CEO Masayoshi Son. With the proliferation of PCs and mobile devices, Yahoo! JAPAN rapidly expanded its user base, especially as the default browser for mobile devices.

In 2000, Google entered the Japanese market, already known as a powerful search engine worldwide, and quickly expanded its market share in Japan.

In 2001, Yahoo! JAPAN adopted Google’s search technology, allowing it to leverage Google’s advanced algorithms while maintaining its strengths as a unique portal site.

In July 2010, Microsoft’s Bing officially launched its services in Japan. Bing differentiated itself from other search engines with its development concept of “a search engine that supports decision-making”.

Bing has secured a certain market share, particularly in the PC market, largely due to its default setting as the search engine for the Microsoft Edge browser on Windows 10 devices.

SEARCH ENGINE MARKET SHARE IN JAPAN

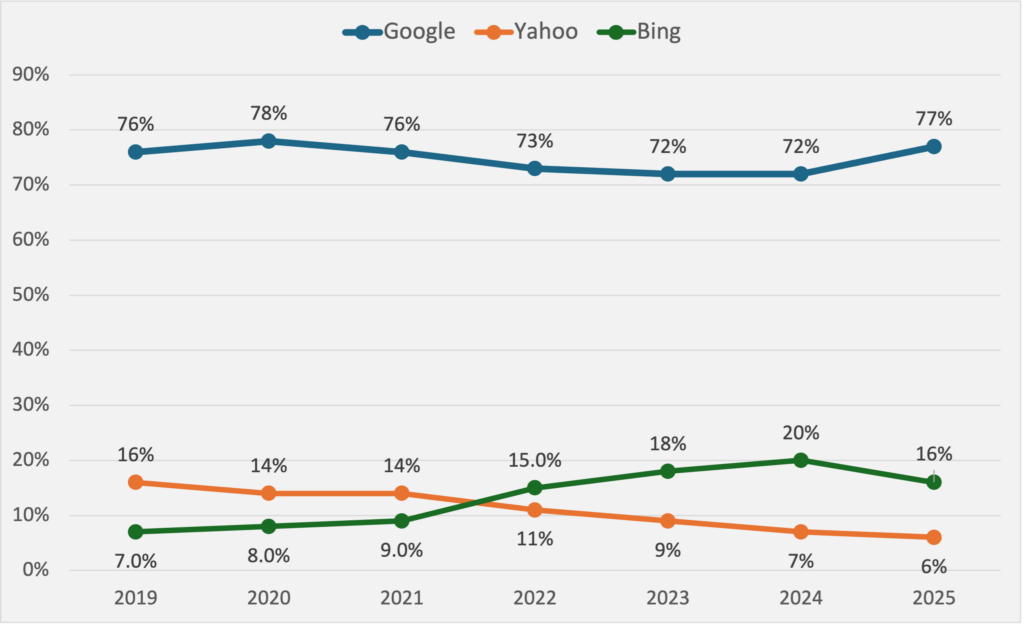

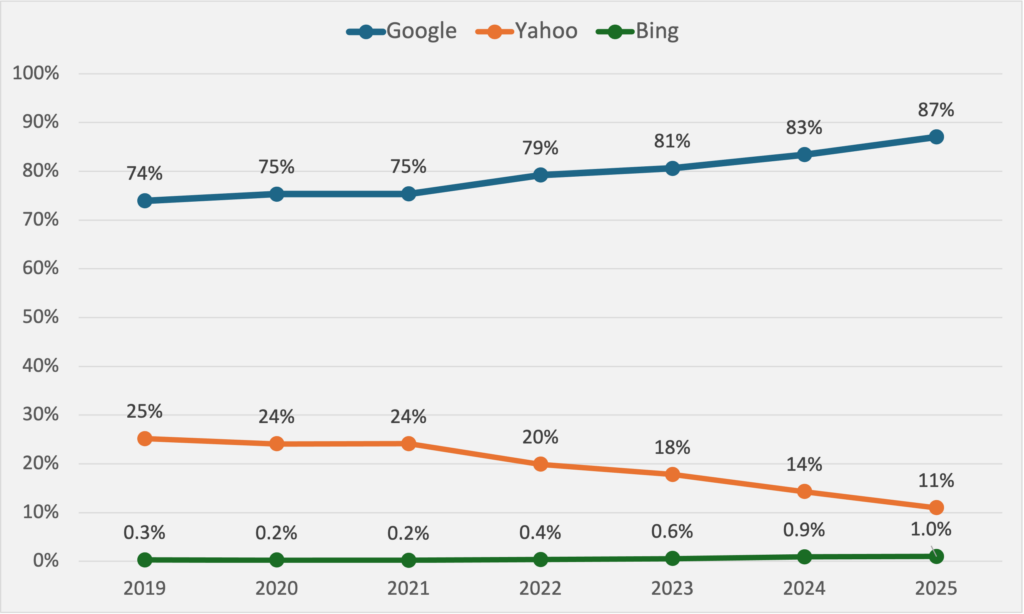

Japan’s search engine market share (desktop): From 2019 to 2025 (as of May 2025)

The desktop search engine market share in Japan has shown significant fluctuations from 2019 to the present. Google has consistently maintained a high market share of over 70% since 2019 and still holds approximately 77% as of 2025. In addition, across all devices, Google holds a market share of 82% in Japan, marking the highest level ever recorded.

Globally, Google’s share of the desktop search market has shown a gradual decline over the years – from 88% in 2019 to 79% in 2025. One of the main drivers behind this shift is the steady growth of Bing.

In contrast, the trend in Japan has moved in the opposite direction. Google’s desktop share increased significantly from 72% in 2024 to 77% in 2025, defying the global pattern.

Google’s dominance can be attributed to its continuous algorithm updates and user-first approach. However, a notable shift has occurred between Bing and Yahoo! JAPAN.

In 2021, Yahoo! JAPAN had a 14% share while Bing had 9%. By 2025, these positions have reversed, with Bing at 16% and Yahoo! JAPAN at 6%. This change can be attributed to Bing’s aggressive adoption of new technologies, such as its early integration of Copilot (AI assistant). Additionally, Bing’s status as the default search engine for Windows has contributed to its increased market share.

Google has continued to dominate the mobile search engine market share in Japan since 2019, consistently holding a share of over 70%, reaching approximately 90% by 2025.

This significant market dominance can be attributed to Google’s default status as the search engine on both Android and iOS platforms.

Meanwhile, looking at overall global search engine market share in mobile, Google has consistently maintained over 93% since 2019. This relative stability contrasts with Japan’s mobile market. Japan is a highly competitive market for Google, suggesting that a market-specific strategy tailored to Japan is essential.

Yahoo! JAPAN held a share of approximately 25% in the mobile market in 2019, which decreased to about 11% by 2025.

Bing’s presence in the mobile market remains minimal, accounting for about 1% in 2025. While Bing has made strides in increasing its market share on desktop platforms, it faces formidable competition from Google and Yahoo! JAPAN, the leading search engines in Japan, in the mobile sector.

Top search engines in Japan: Do You Need Different Optimization Strategies for Yahoo in Japan?

Yahoo! JAPAN’s search engine is powered by Google, which leads many local marketers to consider that SEO best practices for Google also apply to Yahoo. The search rankings are nearly identical on both platforms, but Yahoo, like Google, also displays unique features in its search results.

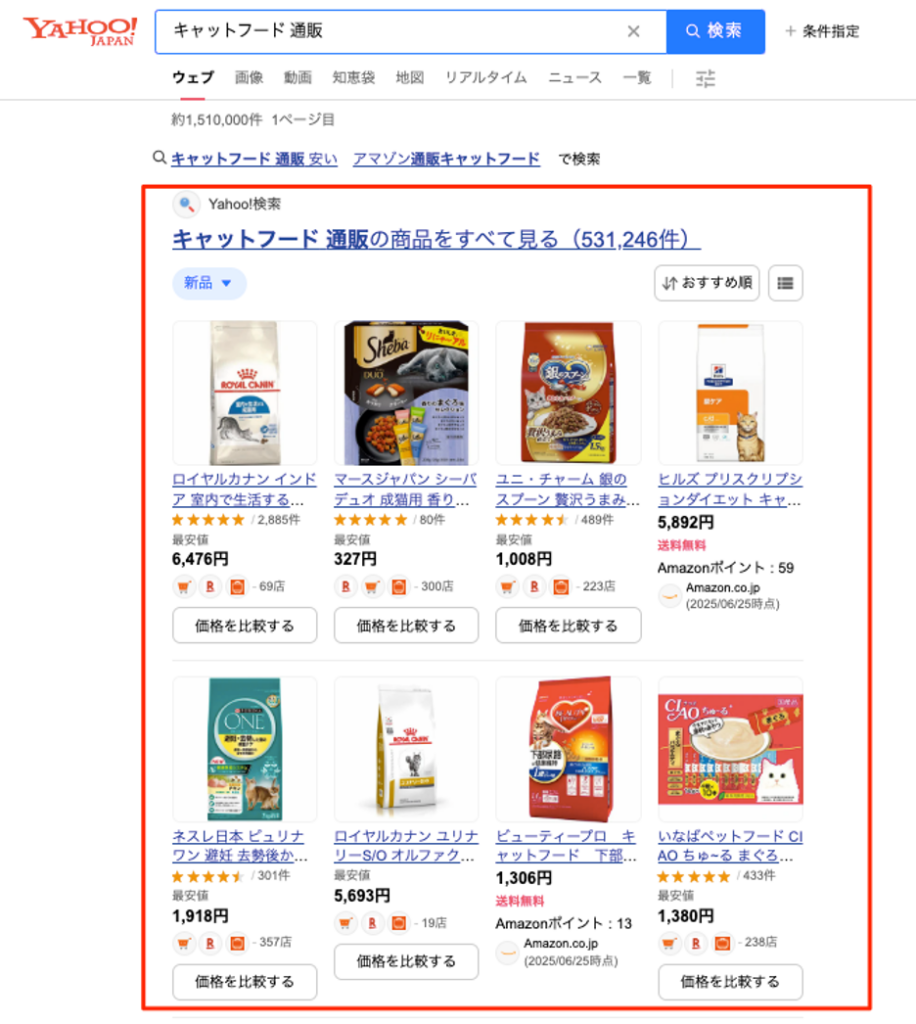

Yahoo Shopping(Yahooショッピング)

Yahoo operates its e-commerce platform called “Yahoo Shopping.” For example, when searching for a term like “cat food online,” product listings from Yahoo Shopping appear in the search results. Clicking on a product link directs users to the Yahoo Shopping page, not to the brand’s website.

Example of Yahoo Shopping

Yahoo Chiebukuro (Yahoo!知恵袋)

Yahoo runs a Q&A platform called “Yahoo Chiebukuro,” which is similar to Reddit or Quora. According to Yahoo’s official website, it has 52 million users, making it the largest question-and-answer site in Japan.

Example of Yahoo Chiebukuro

Differences in SUGGESTED KEYWORDS ON GOogle and Yahoo! Japan

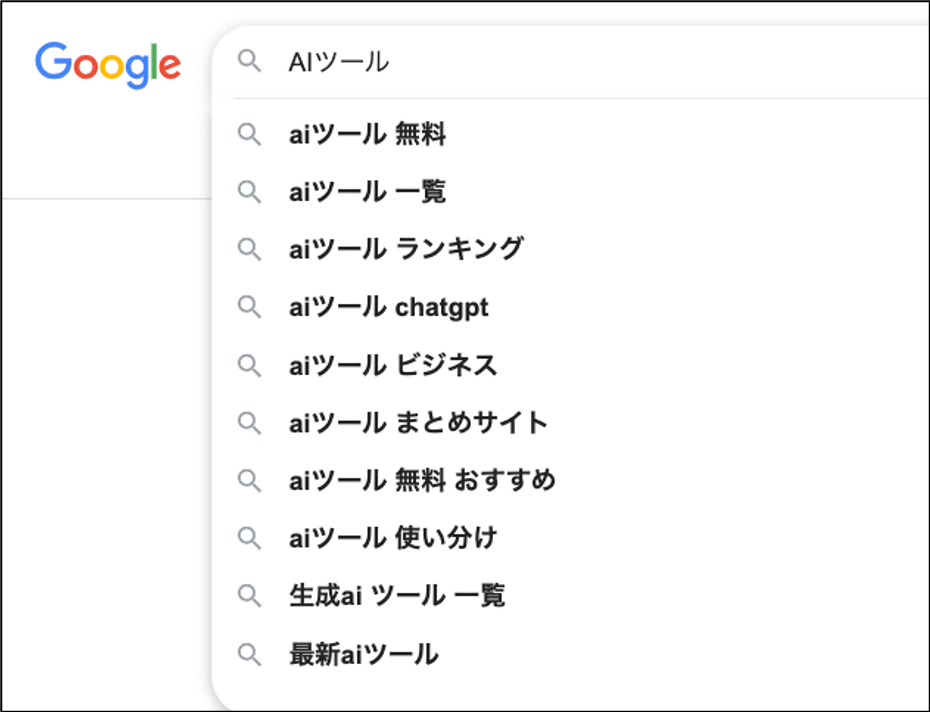

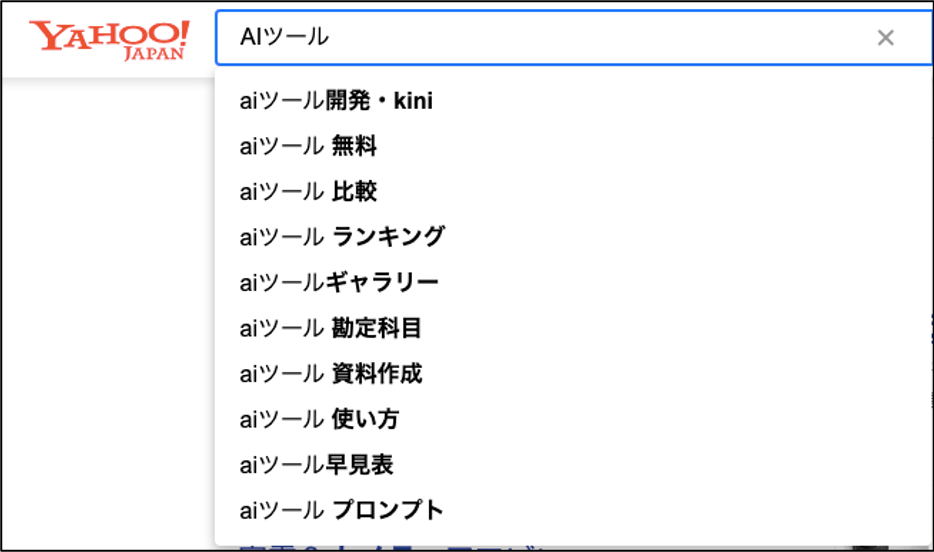

Like Google, Yahoo displays a variety of content types in its search results, including videos, image carousels, and news articles, not just website links. One notable difference, however, is the suggested keywords.

When you search for “AI tools,” some suggestions overlap across both platforms. But on Google, you’ll see terms like “AI tools ChatGPT,” “list of generative AI tools,” or “latest AI tools.” In contrast, Yahoo! JAPAN surfaces suggestions like “AI tools accounting category,” “AI presentation materials,” or “how to use AI tools.” This suggests that while the underlying search technology is similar, the user base differs significantly.

Google’s suggested keywords for “AI tools”

Yahoo’s suggested keywords for “AI tools”

We’ll dive deeper into this in the next section, but these differences in user behavior often lead advertisers to tailor their campaigns differently for Google and Yahoo.

At this moment, Yahoo does not offer AI Overviews (AIO) on desktop. That said, according to its official site, some mobile users are seeing AI-generated answers powered by an “AI Assistant,” which is also built on Google’s technology. Unlike Google’s AIO, which displays a shortened version with a “See more” button, Yahoo shows the full AI-generated response by default. This difference could impact user engagement and perception of authority between the two platforms.

Mobile search results with gen-AI answers comparison of “What is SaaS?”

Ready to maximize your digital marketing in Japan?

The differences between Yahoo and Google can be summarized as follows:

Key Differences Between Google and Yahoo! JAPAN

|

|

Yahoo! jAPAN |

|

|---|---|---|

| Search Engine Technology | Proprietary (Google) | Uses Google’s search technology |

| Search Features | Rich snippets like location info, FAQs, and AI Overviews (AIO) | AI-generated answers are only available to some mobile users; stronger integration with Yahoo-owned services |

| E-commerce Integration | Product listings typically link to external e-commerce sites | Products from Yahoo Shopping appear directly and keep users within Yahoo’s ecosystem |

| Suggested Keywords | Tends to show trending or tech-savvy terms, often with English mixed in | Shows more practical or everyday terms related to work and life |

How to Advertise on Yahoo! Japan

Yahoo! JAPAN offers both search and display advertising, similar to Google. Its display network is especially robust, extending beyond Yahoo-owned properties to include major Japanese media outlets and LINE, the country’s most popular messaging app.

While Yahoo Ads and Google Ads share many core functionalities, they differ in terms of available targeting features and audience reach. Even though both use the same underlying search engine, the user demographics and behaviors can vary. It’s important to align your ad strategy with your target audience and business objectives.

User Demographics: Google vs Yahoo! Japan

|

|

Yahoo! Japan |

|

|---|---|---|

| Primary age group | Mainly 20s–40s | Mainly 30s–60s |

| Gender | Slightly male-dominant (especially in tech-related segments) | Relatively balanced between male and female users |

| Interest | High interest in trends, new tech, hobbies, and shopping | Focused on practicality—interested in lifestyle, health, finance, and education |

| Search behaviour | Proactive and exploratory | Task-oriented and focused on solving specific day-to-day problems |

We don’t recommend skipping Yahoo just because of its smaller market share. In fact, some of our clients have seen stronger performance on Yahoo, including higher conversion rates and engagements, in addition, lower CPC and CPA. Since performance can vary depending on the industry and product, we recommend starting with a test campaign.

That said, setting up and managing Yahoo Ads accounts can be more complicated than Google Ads, even though the interface is available in English. At The Egg, we’ve supported many international clients in launching and optimizing Yahoo campaigns. If you’re interested in exploring this option, feel free to contact us.

DISTRIBUTION OF SEARCH ENGINE TRAFFIC IN VARIOUS INDUSTRIES

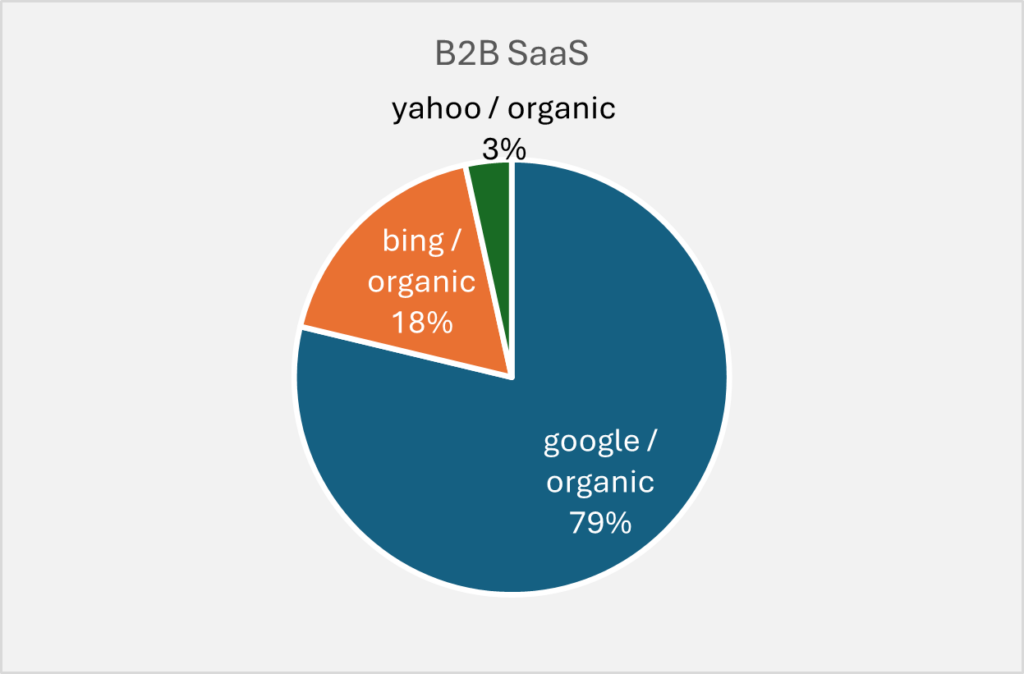

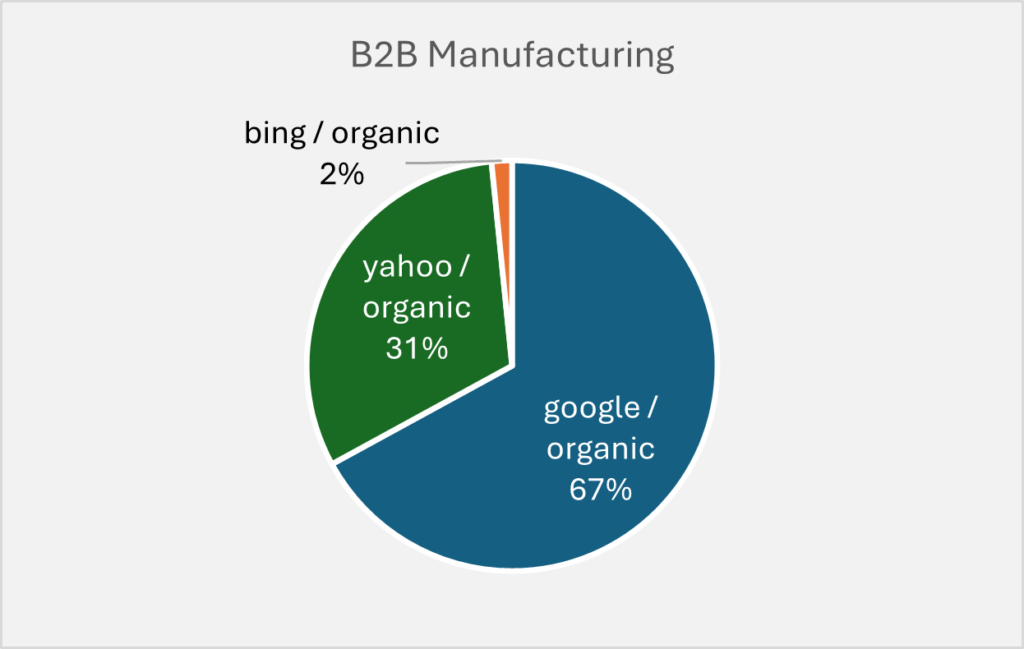

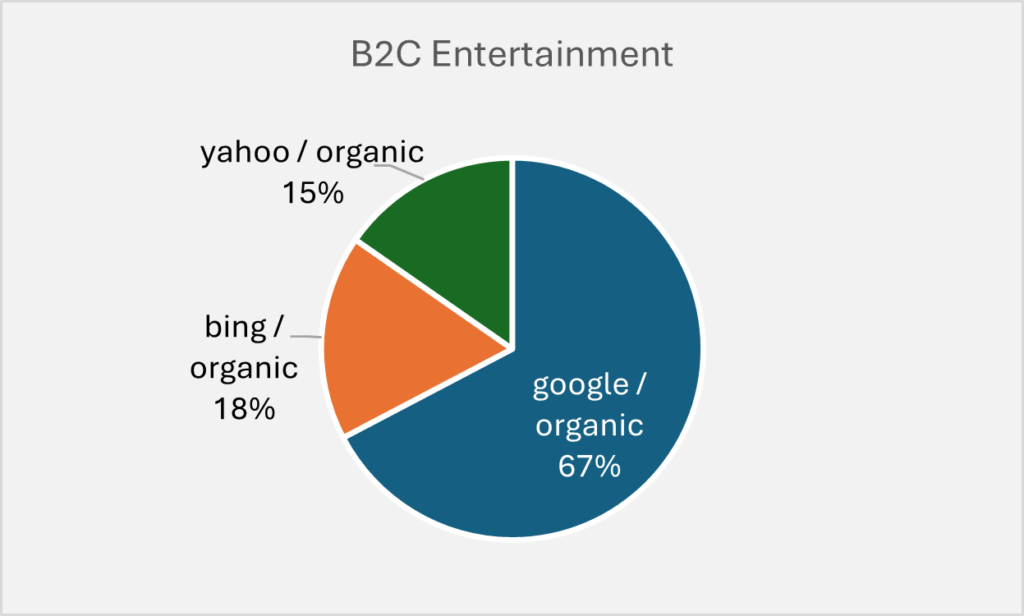

We would like to refer to actual client data that we, The Egg, are responsible for. The pie chart below shows the share of organic traffic for each search engine from January to June 2025, based on Google Analytics data.

Distribution of Search Engine Traffic in B2B Saas

Distribution of Search Engine Traffic in B2B Saas

Distribution of Search Engine Traffic in B2C Entertainment

From the above data, it is clear that Google continues to maintain its dominance as a major source of organic traffic for both B2B and B2C websites. However, we would like to emphasize that the actual share of traffic from different search engines, especially Yahoo and Bing, can vary widely depending on the nature of the website and its target audience.

To maximize the awareness and reach of your brand, it is essential to optimize your search engine optimization (SEO) strategy and set up your advertising accordingly. By doing so, your content will reach the right audience and increase the effectiveness of your digital presence.

In this sense, the discussion should not be about which is the best search engine, but rather about finding the right combination of search engines to suit your business characteristics in Japan.

WHAT IS THE MOST POPULAR SEARCH ENGINE IN JAPAN?

To optimize your online presence in Japan, it is crucial to understand the search engine market there. Google stands out as the top search engine in Japan, accounting for over 82% of search engine usage. Therefore, focusing your SEO and advertising efforts on Google is a strategically sound approach.

While Google Japan holds the title of the most popular search engine in Japan, Yahoo! JAPAN has secured a significant user base due to its unique services and early establishment in the country. It is the second most popular search engine in Japan. Thus, businesses targeting Japanese users should not overlook the potential of Yahoo! JAPAN.

Although Bing holds a smaller market share, it is becoming a valuable platform for companies targeting the B2B sector.

In conclusion, the most suitable Japanese search engine for your company’s needs depends on your specific target audience and business goals. By understanding the strengths and user demographics of each platform, you can develop a digital strategy that effectively reaches your target audience in the Japanese market.

This article has been updated by Akihito Watanabe in 2025.