Debunking the Korean Search Engine Market Share in 2017

Various sites quote different (some very contrasting) search engine market share figures and the South Korean market is no exception. In this article, we reveal why you should be more careful and selective whenever you encounter search engine market share data for Korea. We take you through the different sources of this data and, with some additional data to support it, offer our own informed estimate as to what the current market share most likely is.

Follow our debunking process step-by-step but if you can’t wait to get to the conclusion or other sections of the article, head straight to the section through the links below:

- What the SERPs Say on the Korean Search Engine Market

- What the Search Volumes Reveal About True Market Shares

- What the Trends Show on the Usage of Search Engines in Korea

- What We Can Reasonably Say About South Korea’s Search Engine Market Share

Let’s then start off with:

What the Search Engine Result Pages Say

Sources of the market share data reallly boil down to just a few (some sites don’t even quote their sources). We wanted to see where the top 10 ranking pages obtained their market data from and what their various claims are on the market share.

Here’s what we did:

- Searched for “Korean Search Engine Market Share” on Google.com; searched for the Korean equivalent “국내검색시장점유율” (which actually means “local search market share”) on Google.co.kr

- Visited pages ranking 1-10 (and lower, if necessary) for these keywords

- Identified the sources of the market share data (wherever cited)

Below are tabulated results of the ranking pages and their data source, excluding those pages that do not cite a specific source:

Google.com Results (Open as image)

| Ranking | Ranking Pages for Search Term “Korean Search Engine Market Share” | Market Share Data Source |

|---|---|---|

| 1 | http://returnonnow.com/ | Return on Now |

| 2 | http://www.chandlernguyen.com/blog/ | KoreanClick |

| 3 | http://gs.statcounter.com/ | Statcounter |

| 5 | https://www.ajpr.com/ | Statcounter |

| 7 | http://www.theegg.com/blog/korea/ | KoreanClick (Mobile Data Only) |

| 11 | http://searchengineland.com/ | Statcounter |

| 13 | http://english.yonhapnews.co.kr/ | KoreanClick |

| 16 | https://www.brightedge.com/ | KoreanClick |

| 18 | https://searchenginewatch.com/ | comScore |

| 19 | https://korcan50years.com/ | Return on Now |

Google.co.kr Results (Open as image)

| Ranking | Ranking Pages for Search Term “국내검색시장점유율” | Market Share Data Source |

|---|---|---|

| 1 | http://www.pitchone.co.kr/ | Return on Now |

| 2 | http://kimtaku.com/ | The Search Monitor |

| 3 | http://www.the-pr.co.kr/ | The Search Monitor / KoreanClick |

| 4 | https://hackya.com/kr/ | The Search Monitor |

| 5 | http://biz.chosun.com/ | KoreanClick (PC Query Volume Comparison) |

| 6 | http://ibizcomm.co.kr/blog/ | The Search Monitor |

| 8 | http://www.dongascience.com/ | KoreanClick |

| 9 | http://www.edaily.co.kr/news/ | KoreanClick |

| 10 | http://post.mk.co.kr/ | KoreanClick |

| 11 | http://giantt.co.kr/ | Return on Now |

As you may have observed from the above tables, the sources of the market share data boil down to just a few. Here’s what those sources say about the market share in Korea (open table as image):

| Source | Year | Naver % | Daum % | Google % | |

|---|---|---|---|---|---|

| Sources Optimistic about Google’s Market Share | The Search Monitor | 2015 | 50 | < 13 | 37 |

| Statcounter | 2017 | 23.7 | 5.3 | 68.2 | |

| Sources Optimistic about Naver’s Market Share | comScore | 2011 | 65.6 | 14.4 | 9.6 |

| KoreanClick | 2013 | 73 | 20 | < 7 | |

| Return on Now | 2015 | 77 | 20 | < 3 | |

| KoreanClick (Desktop) | 2015 | 75.6 | 17.4 | 5.0 | |

| KoreanClick (Mobile) | 2015 | 76.6 | 12.0 | 11.4 | |

| KoreanClick | 2016 | 74.3 | 15.8 | 9.9 |

With the above data, we have The Search Monitor and Statcounter on the one hand with Google’s relatively high market share, and then there is comScore, KoreanClick data over the years, and Return on Now with Google’s share much smaller but on the gradual increase even up to 2016.

Is The Search Monitor and Statcounter closer to the truth? It’s not unlikely that Google market share has been on the increase and Naver’s dominance has been challenged by its limitations as a pure search engine, so has the average Korean user finally made the switch to Google and is it now the new face of search in the country?

Or is the comScore, Return on Now, and KoreanClick data more realistic? Isn’t it more likely that Naver has been losing its share gradually over the years and Google still has a long way to go to take on Naver, contrary to what the Statcounter data suggests?

With this split in the market share data quoted by the top-ranking pages, we moved on to compare keyword search volumes on Naver and Google. These should somewhat be a reflection of how much a search engine is being used by the general population. The next section covers what we’ve found with a bit more digging.

What the Search Volumes Say

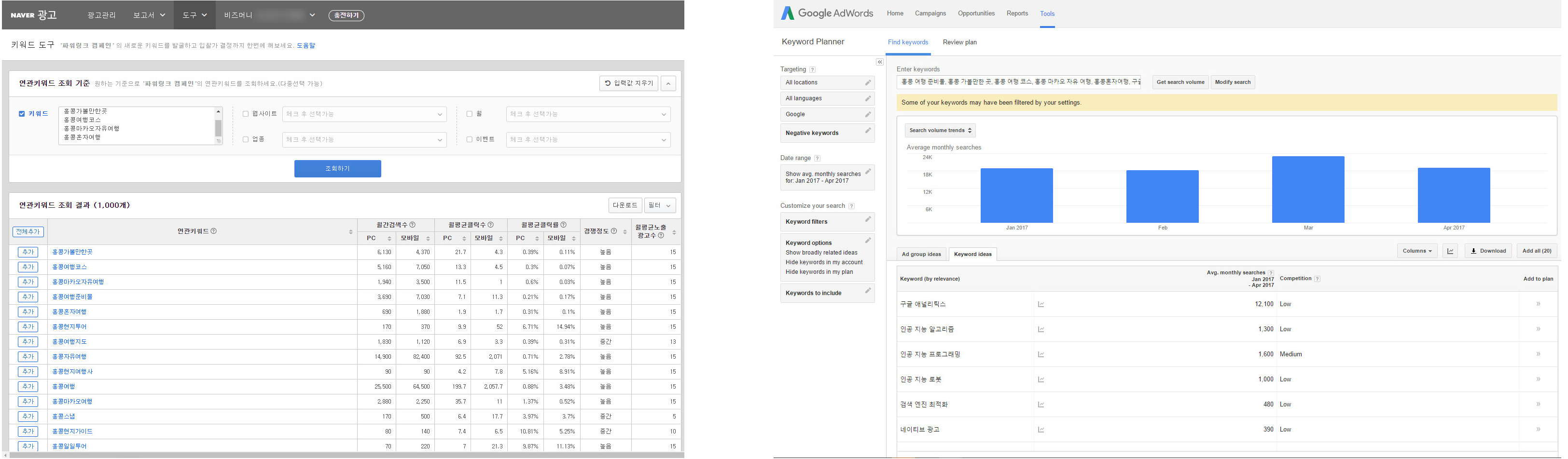

It’s widespread industry knowledge that Naver’s market share has fallen over the years and Google’s has picked up (let’s concern ourselves with just these two engines). So let’s try to gauge how significant the differences in market shares are by comparing search volumes of a sample of keywords on Naver and Google. Since we cannot isolate the search volumes to South Korea on Naver’s Keyword Tool, we did not apply any location filter on the Adwords Keyword Planner either, for consistency.

Image: Naver Keyword Tool vs Google Keyword Planner Interface

For each of 6 different categories, we compared Naver and Google search volumes for 5 keywords (Jan-April 2017), combining both desktop and mobile volumes.

Highlighted in green for each keyword is the search volume that is higher of the two search engines. If Naver search volume is greater than that of Google for a keyword, the Naver search volume is shown in green.

The column “Naver/Google” is Naver search volume divided by Google search volume, indicated how many times Naver search volume is compared to Google’s. The number is highlighted if Naver search volume is more than 10 times that of Google (open table as image).

| Category | Keyword KR | Keyword EN | Google.co.kr Av SV | Naver Av SV | Naver/Google |

|---|---|---|---|---|---|

| Artificial Intelligence | 인공지능로봇 | AI Robots | 978 | 12038 | 12.31 |

| Artificial Intelligence | 인공지능개발 | AI Development | 120 | 518 | 4.31 |

| Artificial Intelligence | 인공지능딥러닝 | AI Deep Learning | 205 | 353 | 1.72 |

| Artificial Intelligence | 인공지능프로그래밍 | AI Programming | 1800 | 613 | 0.34 |

| Artificial Intelligence | 인공지능알고리즘 | AI Algorithm | 1225 | 288 | 0.23 |

| B2B | 기업용클라우드 | Cloud for Businesses | 33 | 228 | 7.00 |

| B2B | 전자문서시스템 | Electronic Document System | 65 | 370 | 5.69 |

| B2B | 기업용메일 | Email for Businesses | 40 | 93 | 2.31 |

| B2B | 기업용메신저 | Messenger for Businesses | 158 | 243 | 1.54 |

| B2B | 프로젝트관리툴 | Project Management Tool | 728 | 353 | 0.48 |

| Economics | 4차산업혁명 | Fourth Industrial Revolution | 33600 | 417150 | 12.42 |

| Economics | 세계경제순위 | World Economic Rankings | 435 | 5333 | 12.26 |

| Economics | 2008년금융위기 | 2008 Financial Crisis | 240 | 2183 | 9.09 |

| Economics/Politics | 영국브렉시트 | Britain Brexit | 240 | 6110 | 25.46 |

| Economics/Politics | 미국의료보험제도 | US Health Care Policy | 193 | 370 | 1.92 |

| Marketing | 네이티브광고 | Native Ads | 413 | 1533 | 3.72 |

| Marketing | 네이버seo | Naver SEO | 80 | 290 | 3.63 |

| Marketing | 검색엔진최적화 | Search Engine Optimization | 508 | 820 | 1.62 |

| Marketing | 구글seo | Google SEO | 345 | 345 | 1.00 |

| Marketing | 구글애널리틱스 | Google Analytics | 12775 | 7550 | 0.59 |

| Programming | 프로그래밍독학 | Self-Learn Programming | 183 | 3398 | 18.62 |

| Programming | 컴퓨터프로그래머 | Computer Programmer | 495 | 3383 | 6.83 |

| Programming | 프로그래밍자격증 | Programming Certification | 223 | 1348 | 6.06 |

| Programming | 프로그래밍언어 | Programming Languages | 1165 | 3433 | 2.95 |

| Programming | 프로그래밍언어종류 | Types of Programming Languages | 348 | 708 | 2.04 |

| Travel | 홍콩마카오자유여행 | Hong Kong Macau Independent Travel | 93 | 7520 | 81.30 |

| Travel | 홍콩가볼만한곳 | Places to Go in Hong Kong | 165 | 10960 | 66.42 |

| Travel | 홍콩여행코스 | Hong Kong Travel Itinerary | 155 | 9703 | 62.60 |

| Travel | 홍콩혼자여행 | Hong Kong Solo Travel | 50 | 2533 | 50.65 |

| Travel | 홍콩여행준비물 | Things to Pack for Hong Kong | 338 | 10888 | 32.26 |

Here are some key takeaways from the above search volumes:

-

- Naver search volumes are much higher for travel keywords – as was expected, since Naver is the go-to search engine for topics with a broader audience and people expecting to consume user-generated content.

- Naver search volumes are also higher for definitions – Korean keywords are generally not very longtail but broad keywords that signal an intent to search for definitions or short answers appear to have comparatively higher search volume on Naver.

- Some keyword search volumes are indeed higher on Google, but there isn’t as much a gap between Google and Naver than for keywords where Naver has higher volume.

- Overall, judging from the sample of search volumes we have here, it doesn’t seem likely that Google is winning the majority market share in Korea in 2017 like the Statcounter data earlier on suggested.

So comparing keyword search volumes have given us a more concrete evidence supporting the persistent of Naver as the dominant Korean search engine. Is there anything else we could look at to support or refute this finding? We move on to simple but powerful tools to compare search trends for the search engines.

What the Trends Say

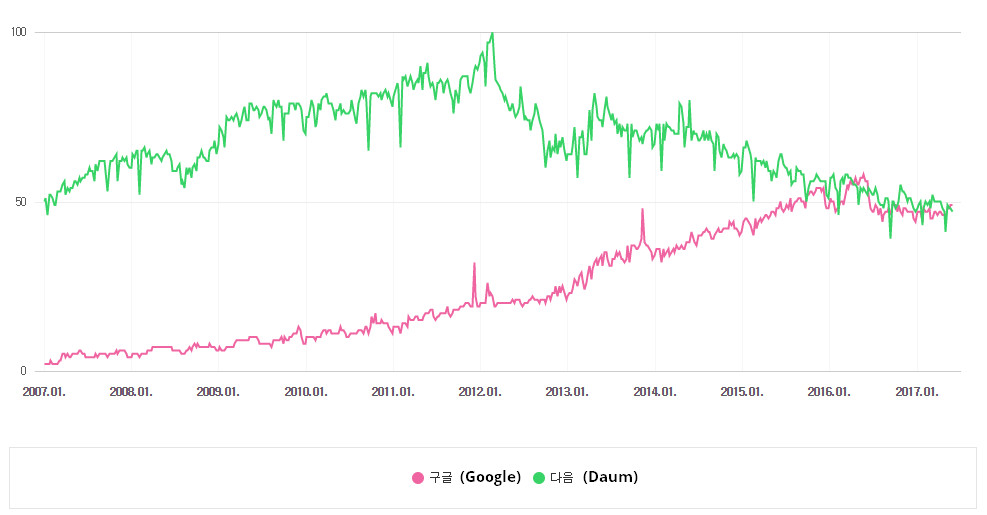

Here we looked at Naver Trends (renamed as Datalab), comparing the keyword trends for “Google” and “Daum”. Assuming Naver is the go-to search engine for internet users, identifying the trend for other search engines on Naver itself will offer an idea of which direction market share is moving toward.

Delightfully, Naver’s Datalab can go as far back as 2007. Below is the trend comparison for “구글” (Google) and “다음” (Daum) from January 2007 to May 2017:

The graph does indeed reflect the market share data that some of the sources revealed – Daum declining, and Google consistently picking up.

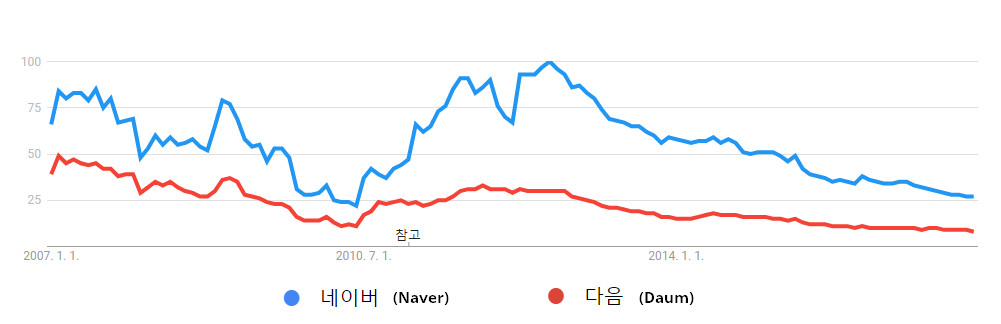

This was interesting so we decided to look up Google Trends as well. Applying the same timeframe but this time comparing the trend for “네이버” (Naver) and “다음” (Daum) on Google, we see the following:

There was an update in 2011 but looking from then and beyond, both Naver and Daum appear to be on the decline – again, reflective of some of the market share data we saw earlier.

What We Can (After All This) Reasonably Say About the Market Share

It can be very tempting to rely on data from Statcounter – it’s highly ranked so easily found, it claims to show the most recent data (as recent as the month immediately prior to the current month), and it seems like a reliable source of data (it’s a familiar source for various data sets).

But from what we’ve seen from other market data sources, actual keyword search volumes, and clear trends in search engine keywords, it is unlikely that Google has indeed taken over the Korean search market as Statcounter seems to show.

It is more realistic to stand behind the sources that show Naver with the majority market share, Daum coming in second, and Google in third, but with shares of the local search engines falling over the years and Google gaining more presence in the market.

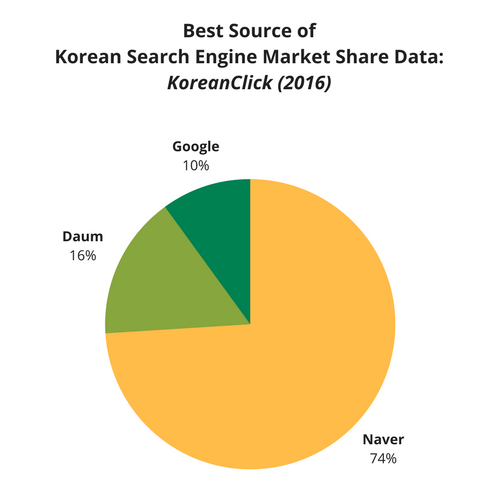

We, therefore, turn to the KoreanClick data for 2016 for the latest search engine market share figures for Korea (at least for now):

The data from KoreanClick for 2016 shows that the dominant search engine in Korea is still Naver (74%), followed by another local search engine Daum (16%), and finally Google (10%). As we’ve seen in the previous sections, while Google’s market share in Korea is small, it has been growing quickly over the years and cannot be overlooked.

What do you think about the debunking of the search engine market share?

Have you come across other data that can help with understanding the Korean search engine market?

Let us know what you think!