In January, CNNIC published another edition of its biannual report.

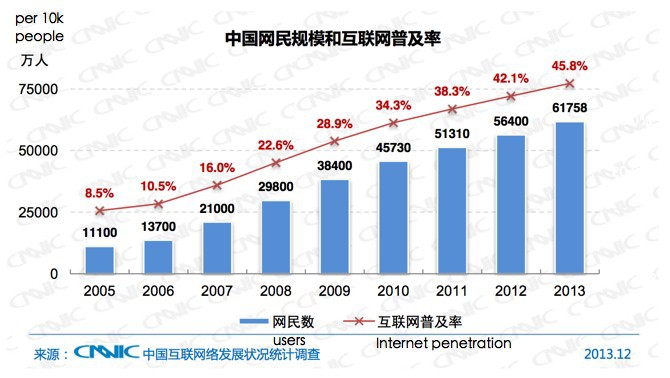

According to the report, China’s Internet penetration has risen over the past year, from 564 million users in 2012 to almost 618 million by the end of 2013. These figures represent an overall increase of 3.7%, however the pace has started to show signs of slowing.

During the first half of 2013, China’s Internet penetration witnessed an increase of 2%, while only a 1.7% increase was recorded in the second half of the year.

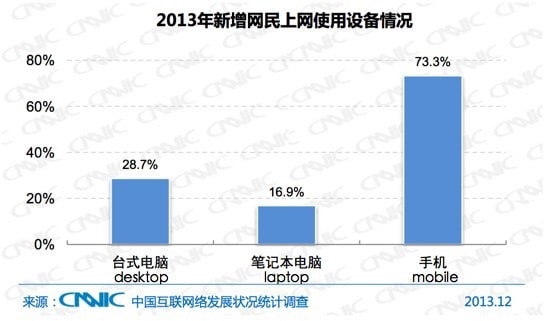

The percentage rate of mobile usage among new Internet users is more marked than that cited in CNNIC’s previous report. In June 2013, over 70% of new internet users used mobile phone devices as their medium of access, in contrast to just 35% of users who favoured desktop access.

As we enter the New Year, these figures have fluctuated to 73% mobile Internet users to 29% desktop. Fitting with an obvious trend of portable devices’ increasing appeal to Internet users as their preferred medium of access, laptop new Internet user numbers rose 4% to 17%.

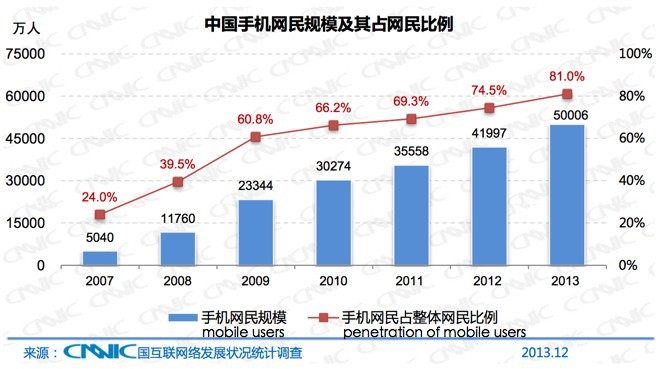

China’s total mobile Internet user numbers currently sit at 500 million, dominating the nation’s total Internet user base with an 81% share.

The first half of 2013 saw a 4% increase of mobile user share, a figure which increased by an additional 2.5% by the end of 2013.

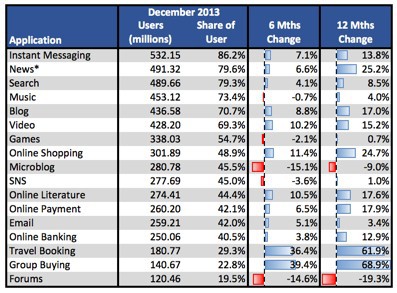

CNNIC’s report reviewed 12 months of change, focused not only on the technology mediums users prefer to access the Internet via, but also honing in on user consumption trends.

In the table below, we have added data from the last report to provide a 6 month comparison chart:

As was saw in the previous report, group- buying experienced the largest growth, with travel booking following as a close second.

At the other end of the spectrum, this data shows that microblogging and social networking have stagnated and even declined somewhat in 2013, while instant messaging remains popular among users.

One of the main causes of the decrease has been user loss among the high- end user demographic (high income and education) to instant messaging platforms that offer similar social features, such as WeChat.

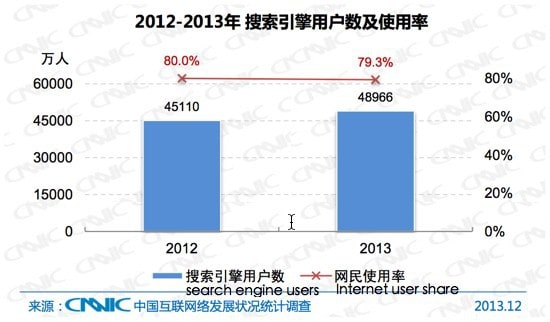

On the other hand, search has experienced only an 8.5% year-on-year growth in user numbers.

Considering the growing Internet penetration, this data indicates that 0.7% less Internet users are using search.

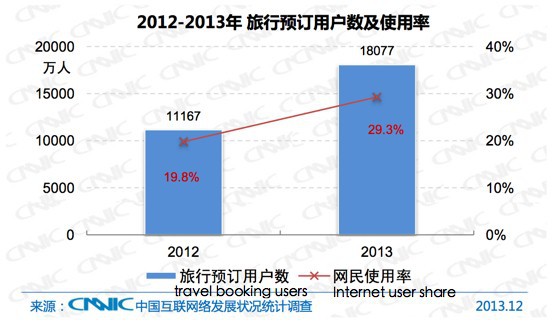

Nearly 29.3% of all Internet users claimed to have completed an online travel booking transaction by December 2013, compared with only 22.4% in June 2013 and 19.8% in December 2012.

The year on year growth for travel booking currently sits at 61.9%, while not as explosive as in 2012 (165.4%), it still demonstrates a positive trend within the industry.

The data also shows that train booking is the fastest growing of all booking types, as we saw 6 months ago. Flight bookings witnessed a steeper increase in the second half of 2013 in comparison.

June represented a low 0.1% growth in the utilization rate of flight booking services, but by the end of the year, this figure has risen to a 3.1% growth rate total. Although this figure sits behind train booking (10.6%), it is still a bigger growth rate than hotel booking at 3% and tour booking at 0.9%.